As I was doing some research this week on the history of copper demand, what started as a focus on China wound up with some interesting revelations surrounding the economic history of neighboring India. Despite going to high school with a number of classmates who had immigrated from India, I never actually took the time to understand the rich history of India, largely because the narrative was always centered around the British Raj and how colonialism saved the poor savages from a grim future.

Nothing could actually be farther from the truth because, for a continuous duration of nearly 1700 years from the year 1 CE, India was the world's largest economy, constituting 35 to 40% of the world's GDP. After the Brits imposed colonial rule in 1858, the state was governed under The British Raj until it achieved independence in 1948. During that 90-year period, the Indian GDP stagnated through plunder by the East India Co. owned by Queen Victoria, and while responsible for the creation of modern railways, canals, roads, bridges, and the system of telegraph links, it resulted in less than 10% of supervisory jobs being held by Indians.

Then, a system of government known for an excess of government intervention in most aspects of economic planning impeded the growth and modernization of the economy until 1991, when a balance of payments crisis forced the liberalization of economic policy, transforming it from command-and-control to laisser-faire capitalism and since then the Indian economy has made tremendous strides in achieving one of the highest growth rates on the plant, achieving a 7.2% GDP growth in 2022 alone.

This is where the story gets interesting. For a country growing at such a dynamic rate, one would think that power generation would be made a priority in order to avoid the loss of power necessary to fuel such a flourishing business environment. However, I was shocked to learn that it was and is certainly not the case.

India has five electricity grids — Northern, Eastern, North-Eastern, Southern and Western. All of them are interconnected to some extent, except the Southern grid. All are run by the state-owned Power Grid Corporation of India Ltd (PGCI), which operates more than 95,000 circuit km of transmission lines. In July 2012, the Northern grid failed with 35,669 MWe load in the early morning, and the following day, it plus parts of two other grids failed again so that over 600 million people in 22 states were without power for up to a day.

A KPMG report in 2007 said that transmission and distribution (T&D) losses were worth more than $6 billion per year. A 2012 report costed the losses as $12.6 billion per year. A 2010 estimate shows big differences among states, with some very high and a national average of 27% T&D loss, well above the target of 15% set in 2001 when the average figure was 34%.

In March 2018, the Indian government stated that nuclear capacity would fall well short of its 63 GWe target and that the total nuclear capacity would likely be about 22.5 GWe by the year 2031. This revised target was reaffirmed by Minister of State Jitendra Singh in December 2022. If India is going to increase its electrical capacity to the order of 40 GWe by 2031, then the amount of copper that will be needed will be enormous, and it will be needed now in order to avoid massive failures.

There are over 30 nuclear reactors either planned or under construction within eight existing power plants, and since India has domestic uranium reserves able to supply them all, the same cannot be said for the copper that will be required in order to expand that sadly-lacking electrical grid.

I believe that the "India Factor" has been largely ignored by those copper bulls, pointing only at China as the engine of demand for copper concentrate. While China has been experiencing a rough period of economic stagnation brought about by the real estate slump, India has not, and as the largely rural population continues migrating to the job-rich urban centers, a large and growing middle class has emerged, contributing to the demand for household amenities that are powered by electricity.

Gold and the Chinese Holiday

Every blogger on the planet that covers gold and silver has now glommed on to the new narrative that with the Shanghai Futures Exchange shut all week; it stands to reason that when it opens again for trading at 21:00 hours on Shanghai Monday, it will scream higher.

Since that is 12 hours ahead of New York time, it means that the re-start occurred on Sunday at 9:00 pm EST. There is no intra-market linkage between the SFE and the Electronic Access Market ("EAM" owned and operated by the Comex, which can result in an Asian premium for similar products such as gold and silver. However, traders on the EAM will surely be watching the SFE for signs that Chinese retail is "back" and ready to take gold and silver higher again.

Shifting back to India, we all know the love affair they have with gold, but import figures from February show that India took in an annual total of 2,295 tonnes of silver in February and when compared with the 3,625 m/t imported in all of 2023, that is an impressive number. Whatever the case may be, I expect that next week will be a "rally week" for the precious metals and the related shares.

Junior Developers

Back in the 1960s, there was a geologist called Ken Dark who toiled as an explorationist for a big U.S. multinational called Texas Gulf Sulfur Company. His team had been conducting basic geology, including geochemical and geophysical testing of an area called Kidd-55 just north of the town of Timmins, Ontario, within a belt of known mineralization called "The Abitibi Greenstones."

Every junior explorer with ground in either the Quebec or Ontario portions of the "Abitibi" all have a teaser page in their promotional materials that talks about the 170,000,000 ounces of gold it has produced, not to mention the billions upon billions of pounds of copper-zinc-nickel-cobalt ore that has been recovered.

Old-timers with whom I worked back in the 1970s spoke of those joyous days in 1963 when reports of a find by Texas Gulf in Timmins sent speculators agog with greed and fear while the smart money grubstaked prospectors with active claims and/or staking crews that could acquire ground and quickly. There was nothing deemed amiss with the project until those staking crews tried to stake ground but to their amazement, it was all staked!

In fact, news of the discovery had been so well-protected that only insiders had been privy to the info so that they could go to all the WWI veterans who were allocated land grants by the Canadian government and buy their land for literally pennies on the dollar. You see, those poor vets had no clue that lurking beneath the surface of the frozen "mill rock" was one of the largest polymetallic base metal deposits in the history of the planet.

Texas Gulf insiders knew it, but very few others knew it, and what transpired was a watershed moment in securities law when, years later, those insiders were forced to disgorge profits they secured by withholding information deemed "material" to Texas Gulf (and other) shareholders. The old-timers' faces would light up like Christmas trees when they talked about all of the penny stocks with ground inside of five miles of the Kidd discovery that they bought in the 10-cent range at traded all the way to $5-10 per share.

To this day, I look with great fondness upon all stories that focus on one of the very few "wonders" of the geological world because in 1978, as I was in training to become a "salesman" for a prominent Toronto-based bond house, a research manager asked me to do a study of the Kidd Creek discovery. At the time, I had zero understanding of mining or geology and certainly not mining stocks but as a reader, I delved into anything and everything I could find about volcanogenic sulfide deposits (Kidd Creek was/is a monster VMS) and what I discovered was that the prime indicator or "pathfinder" minerals associated with VMS deposits were/are andesite and rhyolite. If you were conducting basic geology and were recovering samples loaded with those two highly predictive minerals, you stayed like a dog on a bone in that area.

This brings me to the point of the story. After nearly 50 years of listening to "pitches" by geologists and promoters about "VMS" targets located in the Abitibi, I have never failed to ask about the geochemical results associated with any target boasting of a "Kidd Creek signature" because if they make that claim without the presence of rhyolite and/or andesite, then it is unlikely that it is a "VMS."

All the major VMS deposits in North America, whether they be from Bathurst, New Brunswick, or Flin Flon, Manitoba, contain the rhyolite/andesite signature. In fact, it evolved into a built-in BS detector because of the inability of the presenter to react when I asked about their presence in the geochemical data. If they looked at me with a blank stare, I was out of there within seconds.

Vortex Metals

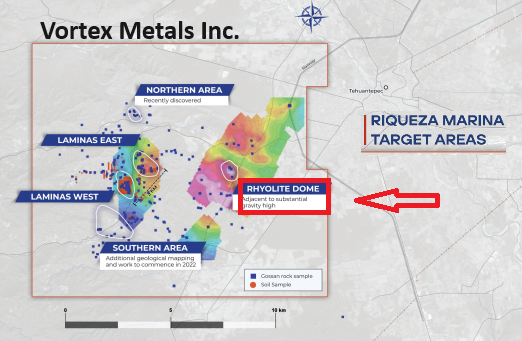

The graphic you see below is a snapshot of a project currently controlled by a recent acquisition — Vortex Metals Inc. (VMSSF:OTCMKTS;VMS:TSX;DM8:FSE) that was originally shown to me by the late David Jones, a brilliant "mine-finder" that gave me a pitch back in 2021 of two highly-prospective projects located in Oaxaca, Mexico.

Currently seeking permits, there are two VMS targets, but the one that I recall was the Riqueza Marina prospect, where a strong gravity anomaly is accompanied by a rhyolite dome.

David is convinced that Riqueza is a "VMS." It carries the potential to be a big base metal deposit and has several interesting features:

- Extensive outcrops and subcrops of high-grade mineralized (Cu-Au-Pb-Zn) gossans occur along a 3km strike length at priority West and East Gossan targets

- Multiple areas of high-grade (>0.5% Cu) surface mineralization

- Large Gravity Anomalies may represent buried massive sulfide horizons

- Substantial gravity high adjacent to a mineralized "Rhyolite Dome"

The company has a copper prospect in Chile that will be drilled later this month but with their portfolio of highly-prospective properties with such compelling geology, the current CA$7 million market cap appears cheap.

With a wealth of managerial experience, the Riqueza prospect is an interesting addition to Illapel (Chile), which I mentioned in last week's missive.

GLD

Gold, as represented by the SPDR Gold Shares ETF (GLD:NYSE) appears to be consolidating, and I believe that by the time it enters oversold territory as it did at the February lows, it will have experienced a 38.2% Fibonacci retracement to the $203.35 level which in terms of June Gold, is down around $2,200.

I remain a stalwart bull on copper and gold, looking out to the balance of 2024 and beyond, but a period of consolidation may be in the cards. I await the return of the Chinese buys to provide clues next Sunday evening.

Want to be the first to know about interesting Base Metals, Critical Metals and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Vortex Metals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Vortex Metals Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.